CORRECTION OF NOTICE OF PROPERTY TAX INCREASE

Correction of prior notice:

The public hearing of the Stewart County Board of Education’s tax increase of 1 mill on September 11, 2025 has been cancelled. Please refer to the published corrected notice for updated hearing dates, times, and locations as well as details.

NOTICE OF PROPERTY TAX INCREASE

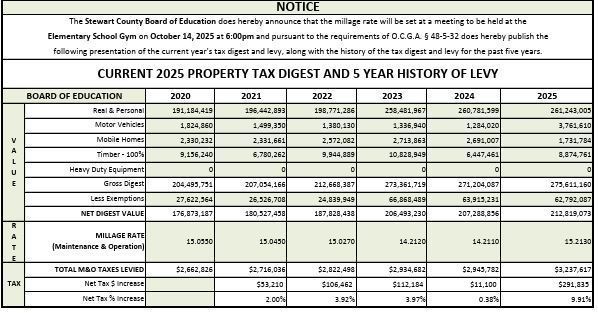

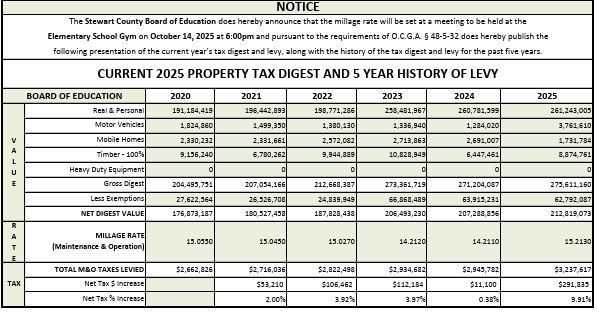

The Stewart County Board of Education has tentatively adopted a 2025 millage rate which will require an increase in school property taxes by 9.91 percent.

All concerned citizens are invited to the public hearings on this tax increase to be held:

Thursday, September 18th 9:00am to 10:00am @ Stewart County High School Gym

Thursday, September 18th 6:00pm to 7:00pm @ Stewart County Elementary School Media Center

Tuesday, October 14th 5:00pm to 6:00pm @ Stewart County Elementary Gym

This tentative increase will result in a millage rate of 15.213 mills, an increase of 1 mill. Without this tentative increase, the millage rate will be no more than 14.213 mills. The proposed tax increase for a home with a fair market value of $100,000 is approximately $38.00 and the proposed tax increase for non-homestead property with a fair market value of $150,000 is approximately $60.00.